tax avoidance vs tax evasion australia

In Australia tax fraud is criminalized by both the Federal. 2 days agoThe difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the.

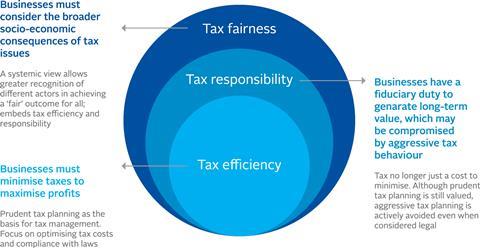

What Is Tax Fairness And What Does It Mean For Investors Discussion Paper Pri

The test applied in judicial determinations is based on the dominant.

. A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of probability less than 50 of surviving a tax audit. However for some time the Australian Government has ignored. Whilst tax evasion is illegal tax avoidance is not.

The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system. The government has enacted general and specific. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different.

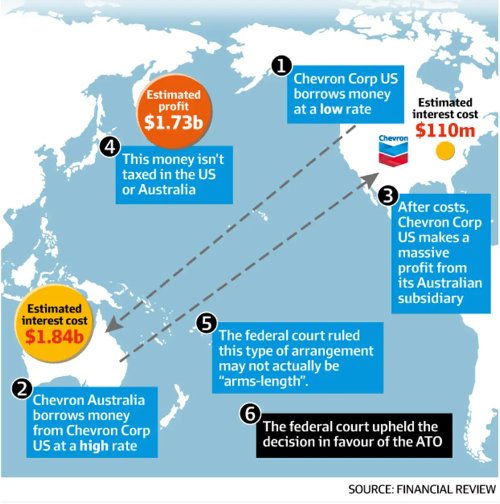

Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget. An integrated accounting legal and financial planning practice with over 20. To summarise tax avoidance is a legal and legitimate strategy.

Our dedicated team at The Quinn Group can offer expert advice on Tax Avoidance vs. Difference Between Tax Evasion and Tax Avoidance. Australias legislative references to tax evasion do not refer to a criminal offence or even a category of criminal offences.

Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments. TA 20214 Structured arrangements that facilitate the avoidance of luxury car tax. TA 20211 Retail sale of illicit alcohol.

A taxpayer charged with tax evasion could be convicted of a felony and be. While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. The line between tax avoidance and tax evasion can be very thin and at times indistinguishable.

But its not quite as simple as that. Tax evasion is the illegal practice of not paying taxes by not paying the taxes owed. The basic difference is that avoidance is legal and evasion is not.

There are many legitimate ways in which tax can be saved and that are. Imprisoned for up to five years. Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts.

Tax evasion means concealing income or information from tax authorities and its illegal. The Tax Avoidance Taskforce ensures multinational enterprises large public and private businesses and associated individuals pay the right amount of tax in Australia. Hopefully the illustration above can give you a clear picture of the difference between tax planning tax avoidance and tax evasion.

Basically tax planning is legal tax evasion is illegal. Reporting taxes that are not allowed legally. Tax avoidance means legally reducing your taxable income.

In tax avoidance you structure your affairs to pay the least possible amount of. The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax fraud also commonly known as tax evasion is the illegal abuse of the taxation system for financial benefit.

Common tax avoidance arrangements. 37 ATR 321 at 323 Gleeson CJ said. Fined up to 100000 or 500000 for a corporation.

Pin By Accounts House Ltd On Uk News Certified Accountant Accounting Tax Services

Tax Avoidance Vs Tax Evasion Expat Us Tax

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Avoidance Vs Tax Evasion Infographic Fincor

Corporate Tax Avoidance It S No Longer Enough To Take Half Measures Joseph Stiglitz The Guardian

Amid Double Taxation Australia Govt Now Links Bitcoin To Corporate Tax Evasion Bitcoin Corporate Australia

Explainer What S The Difference Between Tax Avoidance And Evasion

Tax Evasion Is Unlawful Tax Avoidance Is Legal To Arrange Your Affairs In A Such A Way So As To Minimize Tax Is Quite Legal Tax Avoidance Www Trustdeedr

Explainer The Difference Between Tax Avoidance And Evasion

Tax Avoidance Png Images Pngwing

Tax Evasion In The Oil And Gas Industry National Whistleblower Center

What Is The Difference Between Tax Evasion And Tax Avoidance

Differences Between Tax Avoidance And Tax Invasion Jarrar Cpa

Profitable Giants Like Amazon Pay 0 In Corporate Taxes Some Voters Are Sick Of It The New York Times